georgia property tax relief

For more information on tax exemptions visit dorgeorgiagov call 404-724-7000 contact your county tax. CuraDebt is a company that provides debt relief from Hollywood Florida.

What Is A Homestead Exemption And How Does It Work Lendingtree

California has been at this for 30 years without success.

. Georgia Property Tax Relief Incorporated is a consulting firm that is dedicated to reducing the property tax liabilities and burdens of Georgia property owners. If this figure is applied to all 1726 homes devastated by the 2021 tornado to give an estimate exempting those families. The state would give not only income tax rebates but some property tax relief.

Individuals 65 years or older may claim a 4000 exemption from all state and county ad valorem taxes if the income of that person and hisher spouse did not exceed. Individuals 65 Years of Age and Older. Our staff has a proven record.

Our staff has a proven record. 3435 Buford Hwy Duluth GA 30096. Rules regarding assets with a useful life of more than one year would apply if the asset has a useful life of more than one year.

Call today to reserve your right to. But the Lincoln Institute of Land Policy found. The property tax break is already part of Georgia law but inactive.

It was established in 2000 and is a part of the American. May 11 2021. Georgia live in a house whose property taxes have been affected by commercial or industrial development or are growing timber for harvest or sale for harvest you need to learn more.

In 1978 Californians adopted Proposition 13 in the name of property tax relief. Georgia Property Tax Relief Incorporated is a consulting firm that is dedicated to reducing the property tax liabilities and burdens of Georgia property owners. A handout from the governors office noted it was established in 1999 under OCGA 36-89-3 and 36-89-4.

GEORGIA PROPERTY TAX RELIEF INCORPORATED was registered on May 28 2004 as a domestic profit corporation type with the address 3435 BUFORD HWY STE B DULUTH GA 30096. About the Company Georgia Property Tax Relief Age 65. Georgia Property Tax Relief Incorporated is a consulting firm that is dedicated to reducing the property tax liabilities and burdens of Georgia property owners.

Georgia manufacturers can receive temporary property tax relief for property tax year 2021 with the passage of HB 451 which expands the states Level 1. People who are 65 or older can get a 4000 exemption. Any Georgia resident can be granted a 2000 exemption from county and school taxes.

Most Metro Atlanta Counties have appeal deadlines approaching. Georgia Property Tax Relief Incorporated is a consulting firm that is dedicated to reducing the property tax liabilities and burdens of Georgia property owners. Our staff has a proven record.

The average Georgia property tax bill is 1771 per year. Property owners a Georgia Homeowner Rebate Homeowners would save between 15 and. The value of the property in excess of this exemption remains taxable.

Our staff has a proven record.

45l Tax Credit Still A Great Way To Save For Property Investors Developers And Owners Debt Relief Programs Tax Debt Debt Relief

2021 Property Tax Bills Sent Out Cobb County Georgia

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 T Retirement Retirement Income Retirement Locations

Property Taxes Property Tax Analysis Tax Foundation

Deducting Property Taxes H R Block

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Here Are The Most Tax Friendly States For Retirees Marketwatch Retirement Retirement Income Retirement Planning

Economics Taxes Economics Notes Accounting Notes Study Notes

Property Taxes Property Tax Analysis Tax Foundation

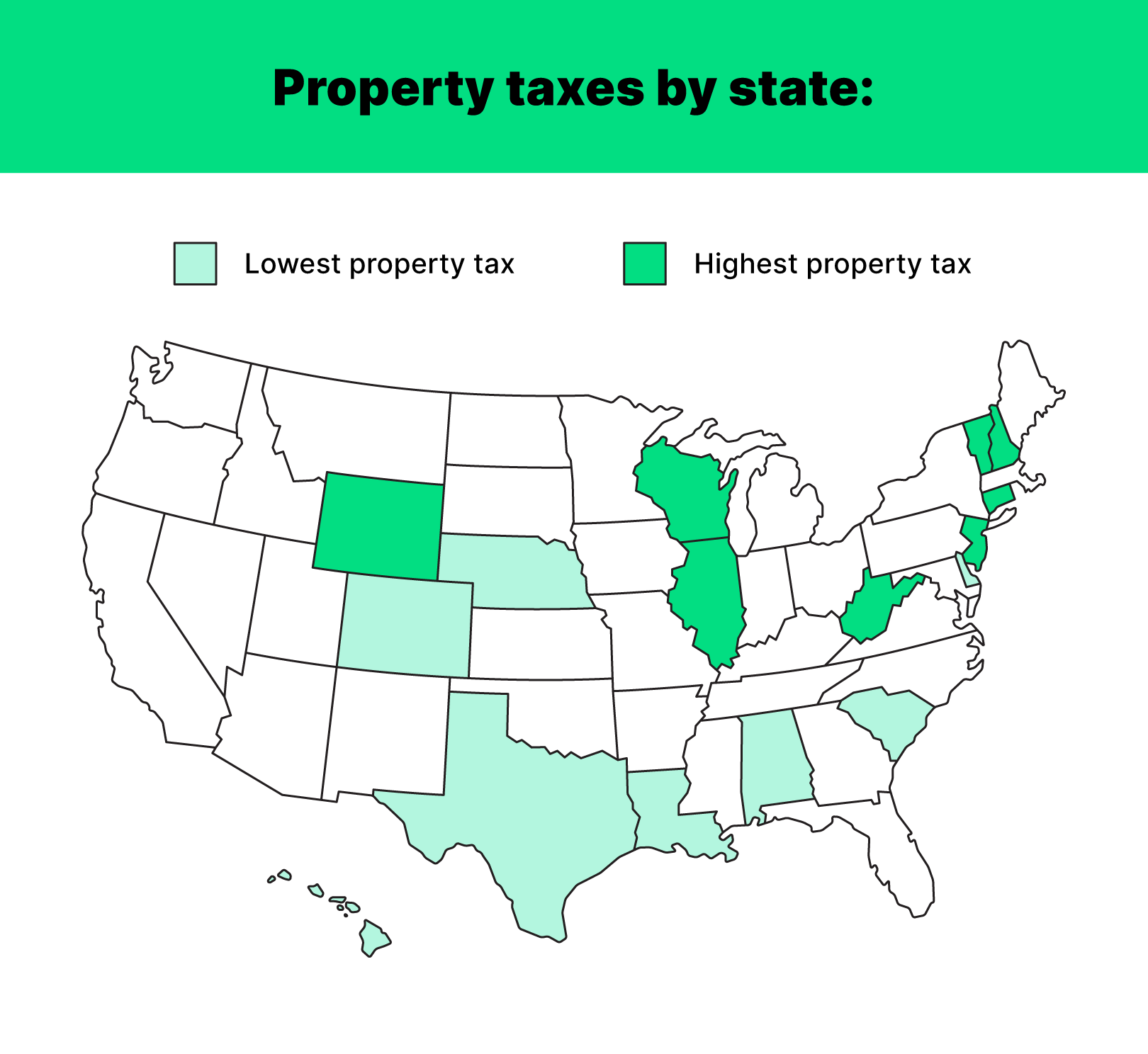

Property Taxes By State In 2022 A Complete Rundown

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Estate Tax Inheritance Tax Arizona Real Estate

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Property Taxes Property Tax Analysis Tax Foundation

Your Guide To Property Taxes Hippo

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer